Monetary Policy Review Statement 2015

RBZ Governor John Mangudya | |

| Time | 0900hrs |

|---|---|

| Venue | Reserve Bank of Zimbabwe |

| Location | Harare |

| Filmed by | Zimbabwe Broadcasting Corporation |

On 11 February 2015, the Reserve Bank of Zimbabwe governor John Mangudya released the 2015 Monetary Policy Review Statement. This was a follow-up review after the initial budget was announced in 2014.

To view or download the 2015 monetary policy review statement click this link

JANUARY 2015

MONETARY POLICY STATEMENT

Rebalancing the Economy

Through Competitiveness and Compliance

BY

DR. J. P. MANGUDYA

GOVERNOR

RESERVE BANK OF ZIMBABWE

INTRODUCTION

This Monetary Policy Statement is issued, in terms of Section 46 of the Reserve Bank of Zimbabwe Act [Chapter 22:15] at a time the nation is in

need of solutions to address the intertwined challenges of uncompetitiveness, low productivity and lack of confidence (or war of

negative perception) besetting the economy.

The major causes of uncompetitiveness of local products are the higher costs of production emanating from high markups to sustain high overheads epitomized by high utility tariffs, finance charges and wages and salaries which are higher than those obtaining in neighbouring countries and beyond. In addition, the continued appreciation of the US$ against the country’s major trading partners’ currencies has made imports cheaper thereby making local goods uncompetitive.

The combination of the above uncompetitive factors has continued to put pressure on the balance of payments position of the country as imports of finished goods have become the order of the day leading to company closures and job losses. Lack of competitiveness therefore needs to be

urgently addressed across all sectors of the economy.

Monetary Authorities’ response to the national challenge of lack of competitiveness due to high markups has been to procure the small denomination coins, bond coins, as change for the US$ paper money to deal with the rounding up of prices by businesses. The introduction of small denomination coins is beginning to have a positive impact on the prices of goods and services. The appreciation of the US$, on the other hand, is outside the influence of monetary policy and should, therefore, be taken as a fait accompli. It can only be addressed through higher productivity and enhancing competitiveness which I will address later in this Statement.

Given the lack of competitiveness and its negative effects on the economy, we do not see any room for wage and salary increases within the national

economy. Instead, the prevailing circumstances call for a downward adjustment in the prices of goods and services in order to promote competitiveness and ultimately for the recovery of the economy. Further wage and salary increases would only serve to choke the economy.

Thus, instead of addressing the welfare of consumers (including workers) from the demand side of the equation i.e. by increasing wages and salaries, I am advocating to address the uncompetitiveness challenge from a supply side of the equation i.e. for the reduction in prices to increase the purchasing power of the US$. Hence, apart from the inability of the economy to carry additional demand burden or load, I am convinced that the economy and consumers would benefit more from a price reduction than from increasing wages and salaries for obvious reasons, chief among them being money illusion. Lower prices would induce more demand through the concept of price elasticity of demand which is good for both consumers and businesses and leading to the

rebalancing of the economy.

The second challenge of low productivity is closely related to lack of competitiveness. Low productivity is attributable to a combination of poor

work ethics (poor work attitudes and lack of discipline) and the use of antiquated plant and machinery within the domestic economy due to lack

of capital or financial resources to replace the old equipment. This challenge would need to be partly addressed by amending the Labour Act

in order to bring it in sync with regional and international best practice to foster productivity. At the same time, mobilisation of financial resources

for the modernisation of plant and equipment is also critical. As Monetary Authorities, we are doing our part in mobilising the required resources by

the economy to upgrade some of the obsolete equipment. In addition, the sluggish performance of the utilities sector both in terms of cost and

supply, especially energy inefficiency, is having a negative impact on productivity.

The third challenge of lack of confidence reflects the war of negative perception which increases country risk that has negative effects on

liquidity and causes despair and despondency amongst many people within the country. Government is addressing this phenomenon by

improving the business investment climate to ensure that Zimbabwe is a good investment destination and to promote the ease of doing business

in the country. The Reserve Bank is buttressing these Government initiatives by engaging the Diasporans through various outreach

programmes to encourage the Diasporans to invest in their country like what is happening throughout the world.

As already stated in my previous Monetary Policy Statement, the above challenges that the economy is facing are not insurmountable. I see

Zimbabwe as an ‘awakening giant’, ready to embrace the ‘Africa Rising’ narrative. The awakening is achieved through rebalancing, recalibrating

or resizing of the economy which requires the nation to concentrate on competitiveness and compliance boosting drivers under a positive motto

that ‘Zimbabwe is back’ in business.

In line with the objectives of the Zimbabwe Agenda for Sustainable Socio-Economic Transformation (ZimAsset), we have identified in this Monetary Policy Statement key focus sectors for improving the external financial position (i.e. foreign exchange generation to shore up the much needed liquidity) of the country. These are mining, (gold, diamonds, platinum, chrome and coal); tourism; horticulture, tobacco and the Diaspora. Agriculture remains critical for food security and supplying inputs to the manufacturing sector. The manufacturing sector’s central role, on the other hand, should substantially be viewed as spearheading value addition and beneficiation that is necessary for economic recovery.

GLOBAL ECONOMIC DEVELOPMENTS

Global economic activity remained subdued in 2014, as the world economy experienced a slower growth rate of 3.3% in 2014 (same as in 2013) against the initially projected 3.7 %. Economic activity was weighed down by the intensification of geo-political tensions between the Russian Federation and Ukraine, as well as political instability in the Middle East and North Africa.

Notwithstanding these downside risks, advanced economies grew from 1.4% in 2013 to an estimated 1.8 % in 2014, largely underpinned by a rebound in economic activity in USA. In addition, supportive quantitative easing, robust labour market reforms, revival in investment, and a reduction in the pace of fiscal tightening, increased contributions from net exports and the stabilization of domestic demand, spurred economic recovery in the Euro-area. The recovery in advanced economies, albeit in an uneven manner, was attributed to the expansion in aggregate demand.

In emerging markets and developing economies, activity is estimated to have slowed down from 4.7 % in 2013 to 4.4 % in 2014. Notably, the weakening of economic activity in China, from 7.8 % in 2013 to 7.4 % in 2014, combined with heightened political tension in Thailand, contributed to the downside risks to recovery prospects in emerging market economies.

Reflecting the deceleration of economic activity in China, one of the world’s largest commodity consumers, international commodity prices retreated in 2014 as shown in Tables 1,2 and 3 and Figure 1.

Table 1: Global Economic Growth (%)

Against the background of declining international commodity prices, economic growth in Sub-Saharan Africa, declined from 5.2% in 2013 to 4.8% in 2014. This notwithstanding, growth patterns in the sub-region remained uneven. For instance, in South Africa, economic growth in 2014 was constrained by recurrent industrial tensions and delays in fixing infrastructure gaps, including electricity constraints. In contrast, economic activity remained resilient in Nigeria, despite poor security conditions and a decline in oil production.

In addition, commodity-dependent economies, particularly in Sub-Saharan Africa, including Zimbabwe, have experienced reduced export revenues,

and deterioration in their balance of payments positions.

Table 2: International Commodity Prices for 2014

Table 3: International Commodity Prices for January 2015

Going forward, global economic activity is expected to improve from 3.3% in 2014 to 3.5% and 3.7% in 2015 and 2016, respectively. The rebound in global activity is underpinned by expected re-acceleration of economic activity in advanced economies (2.4%) and USA (3.6%), compared to 1.8% and 2.4%, respectively in 2013. Economic activity in Emerging Markets and Developing Economies and Sub-Saharan Africa is, however, projected to remain almost the same at 4.3% and 4.7% respectively in 2015. The decline in oil prices is expected to have a positive re-distribution effect from oil exporting to oil importing countries.

Despite the growth impetus provided by the decline in oil prices, offsetting effects from economic slow-down in oil producing countries as well as the

stagnation and low inflation in the Euro-area and Japan, global economic growth is projected to grow by 3.5% and 3.7% in 2015 and 2016, respectively. The ability of the Euro-zone economies to navigate around the possible threat of a deflation and stagnation through quantitative easing, is envisaged to shore up global economic growth.

Figure 1: Commodity Price Indices (2005 = 100)

BALANCE OF PAYMENTS DEVELOPMENTS

Global economic developments continue to have a strong bearing on the country’s external sector financial position or the balance of payments developments particularly in view of Zimbabwe’s strengthening business and economic ties with the rest of the world. In particular, commodity trade continues to be influenced by developments in external demand and supply conditions that determine price trends. This is particularly so, as mineral exports accounted for an average of 51% of total export earnings between 2009 and 2014 as shown below in Table 4.

Table 4: Zimbabwe’s Mineral & Total Export Earnings: 2009-2014

The decline in metal prices experienced in 2014 undermined export earnings for most mining houses, resulting in lower fiscal revenues for Government, and further deterioration of the country’s balance of payments position. This development has effectively undermined the contribution made by commodities to the development process.

Importantly, the marked appreciation of the US dollar against Zimbabwe’s major trading currencies further exacerbated Zimbabwe’s external sector

position. This development increased the uncompetitiveness of Zimbabwe’s external financial position since the appreciation of the US dollar makes Zimbabwe’s imports cheaper while simultaneously undermining the competitiveness of the country’s exports.

Lack of export competitiveness and a relatively high import bill combined with limited access to affordable offshore lines of credit and depressed

capital and financial inflows resulted in the continued precarious balance of payments position thereby affecting the country’s ability to build foreign

exchange reserve buffers, critical to absorb exogenous shocks.

On a total inflow (receipts) and outflow (payments) of foreign exchange basis as recorded by the Reserve Bank, the country received US$7.6 billion

and utilised US$8.9 billion in 2014 as shown in Table 5 below.

Table 5: Global Foreign Exchange Receipts & Payments

Trade Balance

Over the period January to December 2014, the country’s merchandise imports amounted to US$6.4 billion, which significantly surpassed merchandise exports of US$3.1 billion, culminating in a trade deficit of US$3.3 billion. The subdued export performance reflected, in part, the retreat in international commodity prices, lack of competitiveness attributable to infrastructure deficits, high utility costs and high cost of capital and finance.

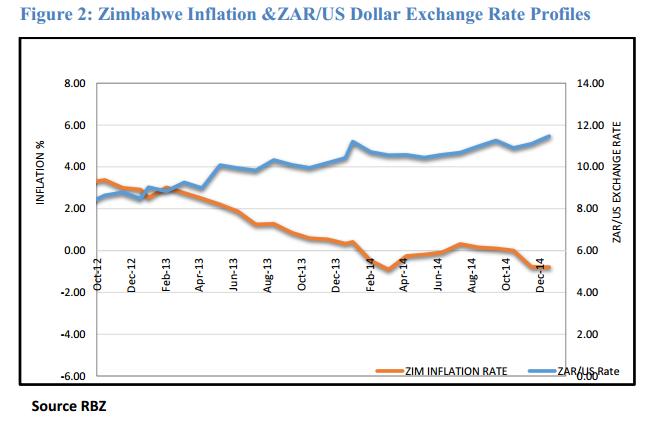

Imports continued to outpace exports as the country continues to lose competitiveness due to the strengthening of the United States dollar against the currencies of Zimbabwe’s major trading partners. Figures 2 and 3 below show the country’s implied Real Effective Exchange Rate (REER) and Nominal Effective Exchange Rates (NEER), both of which have been appreciating since July 2011.

Within the auspices of the multiple currency system, exchange rate developments remain beyond the country’s control. As such, the ability of the country to cushion itself from the vulnerabilities attributed to real exchange rate developments remains a challenge on the back of limited fiscal space.

Figure 2: Zimbabwe Inflation &ZAR/US Dollar Exchange Rate Profiles

Figure 3: Implied REER and Nominal Effective Exchange Rates[1] for

Zimbabwe (January 2009=100)

The trade deficit narrowed by 14 % from US$3.9 billion in 2013 to US$3.3 billion in 2014, reflecting the positive effects of the decline in crude oil

prices and the policies put in place by the Reserve Bank for business to utilize resources for bonafide transactions.

Figure 4: General Merchandise Trade (US$ Million)

The trade deficit narrowed by 14 % from US$3.9 billion in 2013 to US$3.3 billion in 2014, reflecting the positive effects of the decline in crude oil prices and the policies put in place by the Reserve Bank for business to utilize resources for bonafide transactions.

Current, Capital and Financial Account Developments

The sizeable trade deficit realized in 2014, as well as outflows in the income and services accounts, culminated in the incurrence of a current account deficit estimated at 25% of GDP in 2014. Net inflows in current transfers, though considerable, were outweighed by the deficit in goods, services and income accounts. In the absence of foreign reserve buffers, the current account has largely been financed by inflows from the Diaspora, and debt creating short term and long term offshore lines of credit to the private sector. The Central Bank thus encourages acceleration of the on-going ease of doing business reforms in order to create an investment climate that is attractive to all forms of productive capital that support export growth. -400 -200 0 200 400 600 800 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Exports Imports Trade Balance17

Overall Balance of Payments Position

Notwithstanding the huge current account deficit and subdued capital and

financial inflows, the overall balance of payments position is estimated to

have marginally improved from a deficit of US$366 million in 2013 to an

estimated deficit of US$351 million in 2014, as shown in Figure 5 below:

Figure 5: Overall Balance of Payments (US$ Million)

Source: Reserve Bank of Zimbabwe

DOMESTIC ECONOMIC DEVELOPMENTS

Domestic Output

Reflecting the effects of adverse external sector developments on the domestic economic activity, economic growth is estimated to have declined from 4.5% realised in 2013 to 3.1% in 2014. With the exception of the strong performance in the agriculture sector, which grew by 23.4% in 2014, performance in most of the sectors remained subdued. The agriculture sector benefited from the favourable 2013/14 rainfall season -4000 -3000 -2000 -1000 0 1000 2000 3000 4000 2008 2009 2010 2011 2012 2013 2014 2015 Current Account Capital Account Overall Balance18 and support from Government and cooperating partners. This resulted in more than anticipated performances by major crops like maize and tobacco. Challenges in manufacturing, mining and other sectors, however, continue to weigh down the economy’s growth potential. These sectors are estimated to have shrunk by -4.9% and -2.1% in 2014, respectively. The decline in the manufacturing activity, reflected by the fall in capacity utilisation from 40% in 2013 to an estimated 36% in 2014, emanated from persistent challenges which include antiquated plant and machinery, influx of cheap imports, high cost of production, and weak demand associated with the prevailing liquidity constraints and imports. The mining industry performance was set back by the general decline in diamond exports, international commodity prices, frequent power outages, obsolete equipment and inadequate funding for recapitalization, among other challenges. Going forward, the economy is projected to further grow by 3.2% in 2015, driven mainly by services, mining and manufacturing sectors. Investments in various infrastructural projects already being implemented in electricity, transport and housing, under ZimAsset are expected to provide additional growth impetus.

Inflation

Annual average inflation, which fell from 3.7% in 2012 to 1.6% in 2013,

declined further to -0.2% in 2014, reflecting the dampening of inflationary 19

pressures, on the back of cheaper imports, mainly from South Africa and

limited access to credit lines by key productive sectors of the economy.

During the final quarter of 2014, the economy registered an annual

inflation rate of -0.001% in October 2014, and -0. 8% in both November

and December 2014. The decline in annual inflation in the 4th quarter

2014 were driven by both food and non-food inflation. Annual non-food

inflation, which stood at 1.59% in October 2014, significantly fell to 0.17%

in November and further to 0.13% in December 2014.

Figure 6 below depicts that annual inflation has been on a downward

trend since the beginning of 2012.

Disinflation (Price Correction) not Deflation

The Reserve Bank’s considered view is that the reduction in the rate of inflation in the national economy was and is a necessary process towards correcting the high prices obtaining in the country. It is disinflation and -6 -4 -2 0 2 4 6 8 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 (%) Source: ZIMSTAT, January 2015 Figure 6: Annual Inflation Profile (%)20 not deflation. Instances of disinflation are not uncommon and are viewed as normal to correct some of the macroeconomic fundamentals due to market failure. The disinflation in Zimbabwe is therefore a good development as it increases the consumers’ purchasing power. Disinflation is different from a deflation phenomenon which is caused by businesses lowering prices in a desperate attempt to get consumers to buy their products. In the case of Zimbabwe, businesses are lowering prices not because of lower demand but because imports are coming into the country cheaper due to the weakening of the major trading partners’ currencies against the local unit of account, the US$. There has been a shift of demand from local products to imports due to price factor which in itself is due to lack of competitiveness.

Inflation Outlook

In view of the above, the country’s inflation developments are expected to continue to be influenced by the changes in oil and food prices as well as the Rand/US$ exchange rate dynamics. Broadly, inflation is expected to remain in the negative territory for the greater part of 2015, reflecting the effects of depressed international oil and food prices, weaker currencies against the US$ and the positive effect of disinflation in the economy.

FINANCIAL SECTOR DEVELOPMENTS

Structure and Performance

The banking sector has generally remained stable in spite of the 21 challenging operating environment. The challenges being faced by the banking sector largely mirror the macro-economic constraints in the economy. Notably, credit risk remains the most significant challenge facing the banking sector, whilst liquidity constraints also compound the smooth operation of some banking institutions. Following the closure of Capital Bank Limited and Allied Bank Limited, the country’s banking sector has gone down to 19 operating institutions, comprising 14 commercial banks, one (1) merchant bank, three (3) building societies and one (1) savings bank. In addition, there are 147 registered moneylending and credit-only microfinance institutions. On 15 January 2015, the Reserve Bank issued the first deposit taking microfinance institution licence to African Century Limited which has met the stipulated minimum requirements. The institution will commence deposit-taking microfinance business upon the successful completion of a pre-opening inspection. The coming on board of deposit-taking microfinance institutions is envisaged to enhance access to financial services particularly by the lower income groups of our society, thereby promoting a savings culture in the economy.

Capitalisation

On aggregate, the banking sector’s core capital increased from $790.4

million as at 31 December 2013 to $811.2 million as at 31 December 2014,

on the back of improved profitability. A total of 13 out of 19 operating

banking institutions were in compliance with the prescribed minimum core

capital requirements as at 31 December 2014. The banking institutions 22

which are not compliant with minimum capital requirements are instituting

various measures to ensure compliance. In this regard, most banking

institutions have since submitted plans indicating the preferred strategic

group in which they will operate effective December 2020 and the

accompanying recapitalisation plans which are currently being evaluated

by the Reserve Bank.

One banking institution has already surpassed the $100 million minimum

capital requirement for the Tier 1 strategic group which is effective in

2020, while 4 have capital levels above $50 million as indicated in Table

6 below.

Going forward, boards and senior management of banking institutions are expected to work in close collaboration with the shareholders in order to meet the banks’ own interim capital growth targets. In this regard, there 23 is need for intermediate annual targets that banking institutions should achieve.

Sector Profitability

The banking sector remained profitable, with an aggregate net profit of $52.8 million for the year ended 31 December 2014, which is well above the $3.4 million reported for the same period in 2013. A total of 14 banks out of the 19 operating banking institutions recorded profits for the year ended 31 December 2014. The losses recorded by the other banking institutions are attributed to high levels of non- performing loans, liquidity constraints and incapacity to generate sufficient revenue to cover the high operating expenses. In order to enhance their revenues, banks are instituting revenue enhancing measures coupled with cost containing measures to bolster their earnings capacity, and maximize profits.

Financial Intermediation (Deposits & Loans)

Despite the deceleration in economic activity and adverse external sector

developments, annual broad money (i.e. bank deposits excluding

interbank deposits) grew by 13.6% from US$3.9 billion in January 2014

to US$4,4 billion by December 2014. The growth in money supply during

the year, is partially attributed to the liquidity inflows related to the

tobacco selling season earlier in the year. The 2014 tobacco selling season

realised over US$600 million from sales of 216 million kilogrammes of the

crop. 24

As at 31 December 2014, banking sector deposits (including interbank

deposits) grew by 4% to $5.1 billion, whilst loans and advances were $4.0

billion, translating to a loan to deposits ratio of 78.9%.

Deposits have, however, remained short-term in nature hindering

meaningful financial intermediation. The situation is exacerbated by

limited inter-bank trading, general market illiquidity and limited lender of

last resort function of the Reserve Bank.

Figure 7 below shows the annual M3 growth, levels and structure of

deposits held by banks.

Sectoral Distribution of Loans & Advances

Total loans and advances increased from $3.7 billion as at 31 December

2013 to $4.0 billion as at 31 December 2014. The distribution of the

banking sector lending to the various sectors as at 31 December 2014 is as indicated in Figures 8 below.

Performance of Microfinance Sector

The Microfinance Institutions’ (MFIs’) performance as measured by aggregate lending has largely remained subdued due to inadequate funding. The sector’s total loans amounted to $151.8 million as at 30 September 2014 down from $164.2 million as at 31 December 2013. Portfolio quality as measured by the Portfolio at Risk (PaR) (30 days) improved from 21.6% as at 30 September 2013 to 12.1% as at 30 September 2014. The noted improvement in the PaR is attributable to enhanced credit risk management systems in the sector. In addition, some MFIs are increasingly making use of credit checks. The microfinance sector’s aggregate loan portfolio remains skewed towards consumption at the expense of productive sector funding. Consumption lending which largely comprises salary based loans Light and Heavy Industry 25% State 3% Individuals 21% Trade and Services 2% Agriculture 18% Construction and Property 1% Transport & Distribution 16% Financial Services 1% Other 8% Energy and Minerals 5%26 constituted 54.2% of total loans as at 30 September 2014. The Reserve Bank has been working with the sector’s key stakeholders to promote productive lending. The efforts have started bearing positive fruits as witnessed by the increase in the proportion of productive lending from 29.1% as at 31 December 2013 to 45.6% of total loans as at 30 September 2014. Skills and capacity of microfinance institutions remain weak. The Reserve Bank is working with microfinance stakeholders towards the establishment of capacity building programs tailored for the microfinance industry. These efforts should result in the introduction of certification, diploma and degree programs in microfinance in the very short-term. There has been a notable increase in microfinance activities by conventional banking institutions. Banks are permitted to engage in microfinance business under the Microfinance Act [Chapter 24:29]. In line with best practice, however, and in order to level the playing field, the Reserve Bank enforces applicable microfinance regulations on banking institutions’ microfinance portfolios.

Financial Inclusion

The microfinance sector plays a vital role in enhancing financial inclusion

levels through the provision of appropriate financial services and capacity

building, particularly among the low income groups.

Concerted efforts by MFIs to reach out to remote and outlying areas that

have not been adequately served by banking institutions as part of

broader financial inclusion initiatives, remains commendable. Towards this 27

end, there were 482 MFI branches serving 220,357 clients with 252,565

loan accounts throughout the country as at 30 September 2014.

From the Reserve Bank’s standpoint, it is heartening to note significant

improvements in the level of financial inclusion in the economy as

reflected by the results of the 2011 and 2014 FinScope surveys, shown in

Figure 9 below:

Source: FinMark Trust

Importantly, increased use of mobile financial services have significantly

improved the availability of financial products to the previously unbanked

segments of society. Within this context, providers of financial services

are urged to continue embracing technology so as to reach out to

marginalised communities.

In addition, the introduction of agency banking by some financial sector

players is also enhancing financial inclusion particularly through increased

efficiency and customer convenience.

Non-Performing Loans

Credit risk remained a key challenge as evidenced by the average nonperforming

loans to total loans (NPL/TL) ratio of 16% as at 31 December

2014, compared to 20% as at 30 September 2014 as shown in Figure 10

below.

The decline in the NPL ratio noted over the quarter is largely attributable

to the closure of Interfin and Allied banks and general improvement in

loan quality in a few banks.

Financial Stability

The Reserve Bank is pleased to publish its maiden Financial Stability Report (FSR) together with this Monetary Policy Statement. The FSR evaluates key factors and recent developments in the country’s banking and financial sectors, macroeconomic conditions and the global economy which affect the health and prospects of the financial system. 0.32% 3.55% 3.20% 4.24% 6.17% 7.35% 12.28% 13.47% 15.64% 16.96% 18.49% 20.45% 15.91% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% NPLs/ Total Loans Trend of NPL's from 2009 to December 2014 Figure 1029 The report is a worthwhile exercise in identifying and monitoring key financial trends and emerging risks as well as indicating the macroprudential supervision challenges impacting the financial sector. Going forward, the report shall be produced on an annual basis. Further, as part of enhancing its supervisory tool kit for promoting financial sector stability, the Reserve Bank shall conduct Financial Stability Stress Tests with effect from the third quarter of 2015. These stress tests will complement the current micro-prudential stress testing undertaken by banking institutions using own assumptions and scenarios. The financial stability stress tests and banking institutions’ Internal Capital Adequacy Assessment Programs shall be used to inform the determination of economic capital to be held by each banking institution. The Reserve Bank shall issue standardised assumptions after adequate consultations with the banking sector to promote comparability and ensure a shared understanding of the sources of vulnerabilities by both supervisors and bankers.

Distressed Banks

During the last half of 2014, the Reserve Bank closed two banking institutions, namely, Capital Bank Limited and Interfin Banking Corporation. The Reserve Bank cancelled Allied Bank Limited’s banking licence on 8 January 2015, following voluntary surrender of the licence by the institution’s board of directors. The surrender of the licence is against the background of unsuccessful recapitalization initiatives and resultant failure by the bank to trade out of solvency and liquidity challenges. The legal processes to liquidate the bank have commenced. 30 Resultantly, the number of distressed banks in the sector went down to three. Metbank, Afrasia Bank Zimbabwe Limited and Tetrad Investment Bank, continue to experience some liquidity and solvency challenges. These banks are, however, of low systemic importance, with market shares of 4.46%, 4.18% and 4.97% in terms of loans, assets and deposits as at 31 December 2014. The Reserve Bank has engaged these banking institutions’ boards and shareholders with regards to the proposed turnaround strategies. As Monetary Authorities we continue to closely monitor progress in the implementation of the various plans. The Reserve Bank’s objective is to ensure that the financial sector is free from distressed banks by 30 June 2015.

Tetrad

The scheme of arrangement, which the bank entered into with its creditors to provide ample time to facilitate recapitalization, expired on 31 January 2015. The bank is now under provisional judicial management with a close date of 5 April 2015.

Metbank

In an endeavour to address the current liquidity challenges at the bank, Metbank management and shareholders have embarked on various fund mobilisation strategies in order to pay out outstanding liabilities. To date, most of the small depositors with balances of $10,000 or less have been fully reimbursed. Further, Metbank shareholders are currently negotiating with a foreign 31 prospective shareholder who is expected to infuse fresh capital injection to compliment other business strategies the bank is pursuing to stabilize and spur the bank to full recovery.

AfrAsia Bank Zimbabwe Limited

The bank is currently negotiating with potential investors with the objective of taking up significant equity in the institution. It is envisaged that this development will be key to the institution’s various measures to ameliorate its funding constraints.

STATUS OF THE RESERVE BANK SUBSIDIARIES

Export Credit Guarantee Corporation

Export Credit Guarantee Corporation’s (ECGC) primary objective is to promote growth and diversification of Zimbabwe’s export trade through the provision of financial services that address the needs of exporters. ECGC offers various products including the following: i. Credit insurance and guarantee services which enable exporters to compete more effectively in export markets; ii. Export payments insurance policy; iii. Export Finance Guarantee; iv. General insurance; v. Invoice discounting for exporters; vi. Lines of credit cover; vii. Suppliers and buyers credit insurance cover; viii. Domestic credit insurance; and ix. Zimra bonds.32 I am happy to advise that ECGC has been fully capitalised and will resume its operations in March 2015. ECGC is an important player in the export sector and will play a critical part in the growth of the Small and Medium Scale Enterprises.

Homelink

Homelink’s role is to harness foreign currency from non-residents and other holders of free funds by providing products and services that meet investment and consumption needs of the Diasporans. The actions of the company are driven by the vision to be the Leading Global Partner in Financial & Investment Solutions for Diasporans. The company is profit making and is on a growth path. It plans to grow its balance sheet currently at $20 million to $100 million by December 2017. It is structured into four (4) business units, namely Proplink, [[Easylink Money Transfer|Easylink Money Transfer (Pvt) Ltd, Investlink and [[Masterlink Capital Services|Masterlink Capital Services (Pvt) Ltd]]. Proplink is dedicated to housing and stands development. Houses and stands are sold to the Diasporans and local customers mainly on mortgage. For their convenience, clients also have an option to purchase houses on the open market with Proplink providing financing. Easylink Money Transfer (Pvt) Ltd is an agent of Western Union International responsible for money transfer services. Customers receive money sent from the Diaspora through the unit’s widely distributed branches located in cities, towns and some outlying areas such as Gutu, Chiredzi and Victoria Falls. Customers are also able to send money within Zimbabwe through Easylink branches without the need to have a bank account. The wide geographical distribution comes as a relief to recipients who used to travel long distances to towns to receive their money. This is in line with the Central Bank’s thrust of ensuring financial inclusion to as many people as possible. Masterlink Capital Services (Pvt) Ltd addresses short term financing needs of customers within and outside of Zimbabwe. Investlink promotes the investment needs of the Diasporans. The unit scans for investment opportunities in the country; these are then parcelled to the Diasporans who will mobilize capital from outside of Zimbabwe bringing Diasporan Direct Investment into various sectors of the economy.

Fidelity Printers and Refiners

Fidelity Printers and Refiners has continued to increase the volume of gold it

handled by 10% from 12.661 tonnes in 2013 to 13.899 tonnes in 2014 as

shown in Figure 11. It is projecting deliveries to increase by 7.1% in 2015 to

15 tonnes. 34

Figure 11: Gold Production for 2013 and 2014 (kgs)

Over the period 2012 to 2014, the country witnessed a decline in

deliveries from large scale gold producers to Fidelity Printers and Refiners

from 10.86 tonnes in 2012 to about 9.96 tonnes in 2014. A decline of

about 8.3%.

During the same period, Gold deliveries from small scale producers,

however, increased by 51.1% from 2.6 tonnes in 2012 to 3.9 tonnes in

2014.

Efforts to harness gold by the Ministry of Mines and Mining Development

through the Gold Mobilisation Committee from the small scale sector

including artisanal miners are starting to bear fruit. Measures by this

Committee to ensure increased production by the sector will see more

gold deliveries to Fidelity Printers and Refiners.

Aurex (Private) Limited

This subsidiary shall be resuscitated in March this year for the purposes of diamond cutting and polishing over and above manufacturing of jewellery. Its revival which is in line with the objectives of ZimAsset of beneficiation of minerals, is quite timely given Government policy.

PROGRESS ON BANKING SECTOR REFORMS AND INITIATIVES

Amendments to Banking Act

The amendments to Banking Act were approved by Cabinet. The amendments are designed to strengthen the supervisory and regulatory framework. The major provisions include corporate governance, troubled bank resolution, resolution of NPLs, credit referencing system, registration of bank holding companies and consumer protection. With effect from 2 January 2015, the Infrastructure Development Bank of 36 Zimbabwe (IDBZ) and Small & Medium Enterprises Development Corporation (SEDCO) were brought under the supervisory purview of the Reserve Bank of Zimbabwe through amendments to the Banking Act, [Chapter 24:20]. This means that the two institutions will now be required to comply with the Reserve Bank’s regulatory requirements.

Basel II Implementation

The Reserve Bank is reviewing a number of proposed revisions to Basel II framework which are under consideration by the Basel Committee on Banking Supervision (BCBS) and community of bank supervisors on the global arena. In particular, the proposed revisions to the Standardised Approach for credit risk seek to strengthen the existing regulatory capital standard in several ways. These include: a) reduced reliance on external credit ratings; b) enhanced granularity and risk sensitivity; c) updated risk weight calibrations; d) more comparability with the internal ratings-based (IRB) approach with respect to the definition and treatment of similar exposures; and e) better clarity on the application of the standards. These developments will significantly affect the design of the Basel II framework that will be implemented by banks in Zimbabwe. The Reserve Bank adapted the Standardised Approach for credit risk for the local market. The Basel Committee is also reviewing the Operational and Market risk standardised approach frameworks to incorporate lessons from the global financial crisis. The Committee is going to substitute gross income as a 37 proxy of operational risk with an income statement based measure of size, while market risk revisions are, inter alia, focused on clarification of the separation of the trading and banking book. In this regard, banking institutions are hereby required to continue parallel running the old framework and Basel II framework until the current consultations are finalised. The requisite policy positions will thus be communicated to the market in due course. Meanwhile, banking institutions are required to submit their ICAAP documents by 31 March 2015 in line with the requirements in Circular No. 3-2014/BSD: Supervisory Expectations for Internal Capital Adequacy Process.

Resolution of Non-Performing Loans under ZAMCO

Further to my Maiden Monetary Policy regarding the establishment of the Zimbabwe Asset Management Corporation (ZAMCO), an independent asset management company, to resolve the scourge of NPLs, I am pleased to advise that the company is now operational, with the requisite governance structures. The Corporation is modelled along similar asset management companies formed in other countries such as in South Korea (Korea Asset Management Corporation), Nigeria (Asset Management Corporation of Nigeria), Indonesia (Indonesian Bank Restructuring Agency) and Malaysia (Danaharta). An autonomous eight member board was appointed and has met more than four times since its formation. A fully fledged secretariat is in place and currently seized with putting in place structures, systems, policies and 38 procedures. The Reserve Bank is committed to ensuring that ZAMCO’s systems and processes are in line with international best practice. In that regard, I am pleased to advise that ZAMCO received technical assistance from IMF in December 2014. ZAMCO’s strategy for funding the acquisition of NPLs will comprise a number of options including Government funding through long term debt instruments already approved by Government as enunciated in the 2015 National Budget Statement. To date, ZAMCO has acquired NPLs amounting to $65 million using other financing mechanisms provided for in its funding strategy. ZAMCO will acquire NPLs that meet its eligibility criteria. The initial acquisition phase will focus on NPLs that are fully secured and which are not insiders. This NPLs acquisition approach is meant to prevent creating moral hazard in the banking sector. This will also avoid ZAMCO being seen as pardoning past bad lending decisions. As part of the preparatory work the Reserve Bank in conjunction with ZAMCO carried out a market-wide exercise in December 2014 to ascertain the level of NPLs that meet the eligibility criteria. Banking institutions will, by 31 March 2015, be advised of NPLs in their respective loan portfolios that meet ZAMCO’s eligibility criteria. Market wide acquisition of the NPLs will be conducted on a phased approach basis once legal due diligence and independent valuation 39 processes on eligible NPLs and their respective underlying collateral are undertaken and completed. The phased acquisitions of NPLs from banks will commence once ZAMCO has finalized its operational modalities which will be communicated to all banking institutions.

Consumer Protection

The country, through the Ministry of Finance and Economic Development, is receiving World Bank technical assistance in consumer protection and financial literacy. Meanwhile, the Reserve Bank has requested the Ministries of Primary & Secondary Education, and Higher & Tertiary Education; and tertiary institutions to consider incorporating programs into their curricula earmarked at improving financial literacy levels in the country. Amendments will be effected to the Banking Act to include consumer protection provisions prohibiting unfair, deceptive and predatory lending practices. Any such banking practices will attract stiff monetary penalties.

Capitalisation of the Reserve Bank

I am pleased to advise that Government has capitalised the Reserve Bank to the tune of US$ 100 million using long dated debt instruments. This important milestone shall go a long way in building confidence within the economy and in providing the necessary conditions towards the resumption of the Bank’s Lender of Last Resort function.40 This important step in the capitalisation of the central bank now needs to be supported by the passing of the Reserve Bank Debt Assumption Bill by Parliament. The prayers of the Reserve Bank are for Parliament to pass the Bill, which is in its second reading, in order to cleanse the Bank’s balance sheet and to bring normalcy in the financial sector.

Credit Reference Bureau

The Reserve Bank is pleased to advise that a Credit Registry Department has been established as a unit in the Bank Supervision division. The unit will coordinate the collection of credit information from all banking institutions and microfinance institutions and maintain the databank for the credit registry. A number of Credit Reference Bureau (CRB) project processes and activities are scheduled for execution over the next 12 months to ensure that the CRB is successfully rolled out. In the meantime, the requisite amendments to the Banking Act have been approved by Cabinet to provide for adequate legislation to cover operations of the credit registry and appropriate regulations for the licensing and operation of private credit reference bureaus. The Reserve Bank shall engage all the data providers in the sector, such as banks and MFIs, through workshops to build enough capacity particularly on the preliminary steps such as the data clean-up exercise and usage of credit information and reports. The Reserve Bank shall, in collaboration with data providers as well as the Credit Providers Association and private credit bureaus, work on the development of a standard data submission template to enable data providers to submit data in a standardised format. Going forward, the Reserve Bank shall also conduct education and sensitization campaigns in order to promote an understanding of the benefits accruing from the establishment of CRB.

Enhancement of the Guidelines on Relationship with External Auditors

The developments in the local banking sector over the last few years as well as the Global Financial Crisis which started in the USA in 2007 have revealed weaknesses in risk management, control and governance processes at banks. In addition, bank supervisors noted the need to improve the quality of external audits of banks and strengthen communication between supervisory authorities and external auditors of banking institutions. External auditors of banks play a pivotal role in promoting financial stability when they deliver quality bank audits which foster market confidence in banks’ financial statements. In an endeavour to provide a frame of reference to promote effective independent oversight of the banking sector by external auditors of banks, the Reserve Bank in collaboration with the Institute of Chartered Accountants of Zimbabwe is developing a revised Guideline on the Relationship between Supervisors and External Auditors. The supervisory expectations and recommendations contained therein also provide guidance to assist audit committees in the governance and oversight of the external audit function. The enhanced framework shall be issued to the market in February 2015.

Small Denomination Coins, Bond Coins

The small denomination coins that the Reserve Bank of Zimbabwe introduced into the national economy on 18 December 2014 in denominations of 1c, 5c, 10c and 25c to circulate freely side by side with the US$, Rand, etc are called Bond Coins. The 50c denomination shall be introduced by 31 March 2015. The coins are legal tender issued in terms of Section 44 of the Reserve Bank of Zimbabwe Act [Chapter 22:15]. They are called bond coins to reflect the fact that these coins are backed, anchored, cemented or bonded to a US$ facility that is giving the coins the strength of being at par or one to one with the US cents. The coins are meant to boost competitiveness through instilling or promoting a proper pricing system for goods and services in the country under the multiple currency system. Competitiveness is basically a price phenomenon. A phenomenon caused by the negative effects of rounding up of prices by businesses on the grounds that there were no small denomination coins to correspond and strengthen the US$ pricing system in the country. For instance, due to lack of change the general minimum price of a sweet in the country is 5c whilst a 500ml bottle of water at 50c is more expensive than the cost insurance and freight (c.i.f) price of a litre (1litre) of diesel. This is ridiculous. In view of the above few examples, it is clear the coins are necessary in any economy for providing change and to ensure that money is divisible. Consumers benefit with a low denomination coin as it is proven worldwide that businesses would raise prices without the penny or cent. Coins are therefore essential to eliminate the ‘rounding tax’ that reduces consumers’ purchasing power. A system of rounding up prices leads to uncompetitiveness of local products and a shift of demand to imports. Rounding up of prices is regressive and hurts those least able to afford because they make small cash purchases. The coins are therefore pro-consumers (and pro-poor) and a good panacea to the challenge of lack of competitiveness. Consumers should therefore rise and shine and demand change for them to enhance their purchasing power. Consumers should not accept forced sales. The Reserve Bank is satisfied with the uptake of the coins and the impact that they have had so far on prices of goods and services. Companies such as Delta, Econet, Innscor, Mahommed Mussa, to mention a few have started to reduce their prices and have undertaken to continue to review the prices as a result of the availability of change.

POLICY MEASURES

In order to provide pragmatic solutions to the economic challenges besetting the national economy and to rebalance or recalibrate it in order to realise the vision of an ‘awakening giant’ which is consistent with ZimAsset, the Reserve Bank is putting in place the following measures which are in two parts; namely confidence and production enhancement; and liberalisation and monitoring of foreign payments in line with best practice.

CONFIDENCE AND PRODUCTION ENHANCEMENT

Demonetization of the Zimbabwe Dollar

In line with the policy pronouncement made by the Minister of Finance and Economic Development in both the 2014 Budget Statement and the Mid-Term Budget Statement the Reserve Bank shall be demonetizing the Z$ balances by 30 June 2015. It is envisaged that US$20 million shall be used for this purpose. All genuine or normal bank accounts, other than loan accounts, as at 31 December 2008 would be paid an equal flat amount of US$5 per account. The then prevailing United Nations (UN) exchange rate would be used to convert Z$ balances that were as a result of arbitrage opportunities “burning” and for Z$ cash to be received from the walk-in banking public. The Reserve Bank shall soon publicise the modus operandi of the demonetisation process. The significance of this policy measure is to bring to finality to this long outstanding Government obligation to the banking public and to formally pronounce the demise of the local currency. This is critical to buttress Government’s commitment to the multiple currency system which Government is committed to preserve up until the following economic fundamentals have reached acceptable and sustainable levels: i. Minimum foreign exchange reserves equivalent to one (1) year of import cover; ii. Government budget; iii. Interest rates; iv. Level of domestic business confidence (business sentiment); v. Inflation rate; vi. State of (and confidence in) the financial sector; vii. Consumer confidence; viii. Ability of wages to keep up with prices; and ix. Health of the job market. The reality of the national economy is that all the above economic fundamentals or indicators are weak to even contemplate the return of the local currency.

Distribution of Bond Coins

Currently Bond coins are issued by the Reserve Bank through banks for their onward distribution to the public. This system has its own challenges which have led to some parts of the country not being able to get access to the coins. In order to improve the distribution channel, with immediate effect, all Easy Link Money Transfer Agent outlets shall supplement banks in making the coins available to the public without charging commission or withdrawal fees. The Reserve Bank shall also be launching a Consumer Rise and Shine awareness campaign for the promotion of bond coins in close collaboration with the Consumer Council of Zimbabwe.

Changing Rand Coins for Bond Coins

In addition to distributing bond coins, Easy Link Money Transfer Agent outlets shall, with immediate effect, accept to change Rand coins for Bond coins at the prevailing exchange rate of the Rand to the US$. This policy measure in intended to ensure that the public get fair value for their Rand coins unlike the current situation where consumers are being short changed.

Bank Charges and Lending Margins

The Reserve Bank is pleased to observe that a number of local financial institutions have adjusted interest rates downwards to levels below 10% per annum for their performing customers in the productive sectors of the economy. Such development is greatly appreciated and should be intensified. The Reserve Bank would like to encourage those that are on the wrong side of history and still charging interest rates of 4% above the cost of funds per annum to conduct a self-introspective exercise of their risk management philosophy. Facility fees or arrangement fees of above 2.5% are high and interest rates of 4% above the costs of funds per annum for productive sectors of the economy are not sustainable as they are a good breeding ground for non-performing loans which the Reserve Bank is trying to rein in. Financial institutions in this category are therefore expected to compliment the gesture extended to them by Monetary Authorities under ZAMCO and to reflect the benefits to the financial sector of the establishment of the Credit Reference Bureau. It is also critical for banks to note that quality low profits are much better than high unrealisable profits. Compliance by banks to the above indicative pricing would translate into the lowering of finance costs that are debilitating businesses in Zimbabwe leading to some company closures. Reduction in the cost of doing business through addressing finance costs would result in businesses reducing their prices which is necessary for resuscitating and stimulating the economy.

Lowering Cost of Access to Banking Services

The Reserve Bank has observed that in a number of jurisdictions such as South Africa, India and Canada, conscientious efforts and collaborative arrangements between monetary authorities and banking institutions have allowed for the operation of low cost accounts to make banking more accessible to the public and, specifically, to increase banking reach to all communities. In South Africa, for example, the low income transacting account is called Mzansi Account. The Reserve Bank is pleased to note that some local banks are already providing low cost bank accounts to the banking public in Zimbabwe. In order to widen such initiatives and promote financial inclusion, the Reserve Bank and the Bankers Association of Zimbabwe (BAZ) have resolved that banks, without low cost accounts, should at least provide the banking public with basic banking services at low or no cost with the following minimum features: i. Account opening deposit of $5; ii. Depositors to earn some interest on the balance in their account; iii. No balance statement fees; iv. Average account balance of $300; and v. Copy of national Identity Card (ID) suffice for account opening.

US$200 Million Interbank Facility

The interbank facility supported by the African Export-Import Bank (Afreximbank) under the Afreximbank Trade Debt Backed Securities (AFTRADES) is now operational. This is a great financial milestone. The Reserve Bank would like to express its great appreciation to Afreximbank for its commitment to turn around the fortunes of the Zimbabwe financial sector by structuring and underwriting this facility. The facility would be managed by the Reserve Bank as an agent bank for Afreximbank for the purposes of managing the surplus and deficit participants’ requirements under AFTRADES. The initial borrowers under AFTRADES have already been assessed and approved by Afreximbank. Lending to these approved banks would be strictly against acceptable collateral. The surplus banks’ risk under AFTRADES would be transferred offshore to Afreximbank. The Reserve Bank is pleased with this interbank market facility which is going to address the circulation of liquidity or funds within the local financial sector. The facility shall also be used as a precursor program for the lender of last resort function by the Reserve Bank.

Harnessing Diaspora Resources for Economic Recovery

The Reserve Bank estimates that Diaspora remittances into the country currently stand at around US$1.7 billion and gravitating towards US$2 billion (translating to above 50% of exports) per year, with around 50% (US$840 million in 2014 and US$790 million in 2013) coming through local formal banking channels. This sector is too important to ignore. To this end, Government and the Reserve Bank are putting in place measures to promote investment from the Diasporans, over and above remittances. Through Homelink’s newly set up business unit, Investlink, the Reserve Bank is spearheading investments needs of the Diasporans through integration with economic activities in the country. The Diasporans will syndicate, form consortiums and pool resources for investment in sectors like; Energy solutions through mini-hydro power projects. Tourism sector development through the Theme Parks recently announced by the Tourism Minister. Agricultural sector particularly irrigation and horticulture for the export markets as a way of harnessing foreign currency. Various manufacturing subsectors, including small scale and large scale mining where the Diasporans, as Zimbabwean ambassadors, are expected to exploit provisions of the Indigenization Policy and partner with foreigners in these sectors. Industry in general through the Zimbabwe Investment Authority (ZIA), as well as Trading on the Zimbabwe Stock Exchange (ZSE). The prevalence of high interest rates obtaining in the country presents yet another opportunity for the Diasporans to invest in their country and obtain investments rates higher than in their countries of temporary residence. Other countries’ experience with their Diasporans have shown that the Diaspora is a key sector in economic development. A number of African countries such as Ethiopia, Rwanda, Nigeria, Kenya, Egypt to mention a few, have immensely benefited from Diaspora resources just the way other countries like India, China, Israel, etc have benefited.

Accelerated Gold Production Initiative

In the medium term i.e. in the next 5 years, gold will be driving the

economy’s mineral export revenue. Diamonds with further exploration

are also expected to maintain their strong contribution to the mineral

export revenue although declines witnessed recently on alluvial

production calls for swift responses in the country’s vast diamond fields.

The view of the Reserve Bank is that gold production must be accelerated.

The Reserve Bank as the primary market for all gold produced locally

through Fidelity Printers and Refiners would want to see a market and

policy driven growth in gold production to buttress the Ministry of Mines

and Mining Development’s gold mobilisation programme.

Accordingly, the Reserve Bank has mobilised an initial amount of US$50

million that will be managed by Fidelity Printers and Refiners to accelerate

gold production in Zimbabwe. This fund will finance Fidelity’s own mining

projects and also support viable gold projects.

The Accelerated Gold Production Initiative’s vision is to increase gold

production to 30 tons per year by 2020, i.e. revenue of around US$1.5

billion at current prices. This target is achievable as in 1999, the country

produced its highest ever gold tonnage at 27 tons at a time when artisanal

production was very minimum at around 5%. Thirty percent (30%) of the

gold the country’s gold production is now coming from the artisanal and

small scale producers.

Gold, like diamonds, has also contributed the most leakages that the

country has ever experienced especially though Beitbridge border post.

Measures to curb leakages are currently being implemented in full force

through the gold mobilisation programme.

Fidelity Printers and Refiners shall enter into an agreement with ZMDC for

the establishment of a special purpose vehicle to exploit gold under

Fidelity’s ZimGold as shown in Figure 12 below. This vehicle will focus on

harnessing low hanging gold resources with particular emphasis on

alluvial and prolific reef deposits supported by bulk open pit mining and

on old underperforming assets as a preferred mining method to enhance

gold deliveries. ZimGold will structure its operation such as to provide for

contract gold mining and own gold mining. It will also acquire interest in

brownfields projects and venture capital gold structures to boost

production.

Enhanced Coal Production

The Reserve Bank has also arranged an US$18 million facility to be used by Hwange Colliery for the purchase of equipment that they need for enhancing coal production. This is necessary to enable Hwange Colliery to be able to supply the requisite coal needed for the generation of electricity by the Zimbabwe Power Company (ZPC) mainly at Hwange Thermal Power Station. Some of the coal would be for export.

Platinum Refinery Project

Platinum exports in mate form at around US$45 million per month (or around US$540 million per year) are quite impressive. This makes the construction of a platinum refinery an important development that requires to be accorded a national project status to ensure that all the platinum is beneficiated in Zimbabwe. The Reserve Bank shall continue to monitor developments under this project as it is an essential source of export revenue to the country.

Rehabilitation of the Manufacturing Sector

The Reserve Bank, in close liaison with the Ministry of Industry and Commerce and the Industrial Development Corporation, is desirous to find solutions to address the current predicament of the manufacturing sector. The replacement of obsolete equipment in this sector would need to be done on a gradual basis starting with low hanging integrated subsectors. To this end, the Reserve Bank shall during the course of the year, assist in mobilising resources for expanding and restructuring the Distressed Industries and Marginalised Areas Fund (DMAF) to cater for the medium finance requirements of the manufacturing sector. In addition, the Reserve Bank shall in collaboration with banks and through ZAMCO, identify specific cases that need resuscitation through financial restructuring and/or financial engineering like in the case of Lobels, Archer Clothing, Matabeleland Blankets, etc. Cairns would be yet another example that needs financial restructuring. The Reserve Bank is convinced that the above restructuring models, if well managed and carefully thought through, on a case by case basis, would assist to breathe new life in industry in addition to the positive impact of foreign direct investment into this sector.

LIBERALIZATION AND COMPLIANCE MEASURES

The liberalization of current account transactions and the adoption of the multicurrency system in February 2009, culminated in the removal of restrictions on cross border payments. This Exchange Control liberalization framework was adopted in compliance with the SADC`s Protocol on Exchange Controls, which seeks to ensure removal of trade restrictions among member countries. Consistent with the SADC Protocol on Exchange Controls, the Reserve Bank believes that it is necessary to further liberalize exchange control regulations whilst at the same time complying with best practice in order to mitigate incidences of externalization through transfer pricing which has been prevalent following import liberalization. Accordingly the Reserve Bank is further liberalizing exchange control regulations and institute the following measures;

Increase in the Free Threshold on External Loans & Foreign Underwriting

Under the current framework, companies are allowed to access offshore lines of credit of up to USD7.5 million without prior approval by the External Loans and Exchange Control Review Committee while those facilities above this threshold requires prior approval. In order to continue to remove administrative burden in accessing funding required for developmental projects, the threshold of contracting external loans and foreign underwriting of facilities without prior Exchange Control approval has, with immediate effect, increased to US$10 million. The current practice of notifying Exchange Control through Authorised Dealers remains in place. In order to enhance monitoring and accurate reporting of offshore loans, all loans contracted and those approved by Exchange Control shall be granted a validity period by which drawdowns are expected to have been made. In the event that the validity period lapses and no drawdown would have been made, the borrower, where required, shall resubmit the loan agreement to Exchange Control for consideration and issuance of a current authority.

Extension of Amnesty on Non-Recoverable Export Receipts

As at 31 December 2014, a total of USD68.7 million (63%) had been exceptionally acquitted from a total of USD108 million that was declared non-recoverable under absolute amnesty on non-recoverable overdue export receipts. In order to accommodate major exporters with non-recoverable export proceeds that are eligible for absolute amnesty, the period for submission of applications for Absolute Amnesty has been extended to 31 March 2015. Authorised Dealers are required to compliment the generous extension granted by the Reserve Bank by building adequate capacity to ensure that all applications eligible for amnesty are cleared within this period to avoid unnecessary red flagging and fines.

Export Facilitation

The Reserve Bank is desirous to ensure that export documentation is expediously processed by relevant Government agencies. On its part the Reserve Bank through Exchange Control shall ensure that CD1 Forms are processed within a day. Exports permits, where required, should similarly be issued on a similar basis to enhance competitiveness and removal of logjam in production.

Inward and Outward International Remittances

The Reserve Bank has noted that international remittances continue to play a critical role in bridging the country’s financing gap and providing the much needed liquidity in the economy. Total remittances from the Diaspora amounted to $840 million in 2014, compared to US$790 million realized in 2013. In order to ensure that the country continues to benefit from international remittances inflows, the Reserve Bank has reviewed the current Exchange Control framework for international remittances and shall introduce an enhanced and integrated framework with effect from 1 April 2015. Under the new framework, Zimbabwean registered money transfer operators and bureaux de change shall be designated as Limited Authorised Dealers and shall now be allowed to conduct both inward and outward money transfers. The new Exchange Control framework for international person-to-person remittances shall be administered through the following three-tier system. i Tier one (1) shall be locally incorporated money transfer operators (MTOs) partnering with approved international money transfer organizations (MTOs) to carry out both inward and outward international remittances, as well as buy and sell foreign exchange on a spot basis. ii Tier two (2) shall be locally incorporated money transfer operators (MTOs) acting alone, or operating own systems to carry out both inward and outward international remittances, as well as buy and sell foreign exchange on a spot basis. iii Tier three (3) shall be bureaux de change who shall only buy and sell foreign currency on a spot basis. In order to enhance monitoring and accounting of international remittances as well as mitigating against money laundering and terrorist financing, the Reserve Bank of Zimbabwe shall employ a robust compliance monitoring framework including electronic surveillance and reporting or such electronic platform that the central bank may designate for the purpose. All licensed dealers shall be required to participate and contribute to the establishment of the integrated and centralized payment gateway system. The Reserve Bank of Zimbabwe shall give details of the new exchange control regulatory framework and operational guidelines by 28 February 2015.

Business Partner Numbers

The Zimbabwe Revenue Authority (ZIMRA) Business Partner Numbers (BPNs) shall be used by Exchange Control for ease of identifying and monitoring import payments. All corporate importers should therefore with immediate effect include their BPNs on all import documentation when processing payments through their Authorised Dealers.

Import Documentation Requirements

For cross border payments, all importers shall be required to submit current invoices, i.e. not more than 14 days, to their Authorized Dealers, before any payment can be processed, irrespective of the amount involved. The invoice must clearly indicate; i. Consignor and consignee details; ii. Value and nature of goods being paid for; iii. Terms of payment, that is, credit terms or whether advance payments; iv. Delivery period; and v. Declaration by the importer stating that the same application has not been submitted through another bank. Government shall expedite the issuance of import permits, where required, for the importation of raw materials for manufacturing goods as such products are necessary to substitute imports.

Limit on Advance Payment for Imports

In line with best practice and in compliance with the country’s

membership of the Financial Action Task Force (FATF) on Anti-Money

Laundering and Counter Financing of Terrorism (AML/CFT), it is

imperative that the country mitigates red flag indicators that are routinely

used to identify trade-based money laundering activities which include:

i. Significant discrepancies between the description of the

commodity on the bill of lading and the invoice;

ii. Significant discrepancies between the description of the

commodity on the bill of lading (or invoice) and actual goods

shipped;

iii. The size of shipment appears inconsistent with the scale of the

exporter’s or importer’s regular business activities;

iv. The shipment dies not make economic sense;

v. The transaction involves the use of repeatedly amended invoices.

In view of the above and in order to minimise illicit financial flows under

the guise of payment for imports and in line with other countries’ practice

as shown in Table 8 below, the use of the advance payment method for

imports shall, with immediate effect, be limited to US$100 000, or its

equivalent, per transaction for corporates, and 30% of invoice value as

down payment for capital goods. This measure shall not apply to special

circumstances, e.g. fuel, electricity, etc., which shall be treated differently

by Authorised Dealers as shall be communicated to them by the Reserve

Bank.

In line with the absolute Exchange Control amnesty granted last year, the

Reserve Bank would like to advise of the continuity of the amnesty on

instances where there were no imports being sourced that the funds

externalised should be repatriated back to Zimbabwe

Table 8: Regional Comparison on Advance Payments

Business is encouraged to also use other secure methods of payment that

include documentary collection, open account, letters of credit and or

consignment sales. Exceptions shall be treated on a case by case basis

by Authorised Dealers under a framework to be advised by Exchange

Control.

Use of Free Funds

The Reserve Bank is seriously concerned by the abuse of individual or personal accounts to externalize business earnings under the pretext of ‘free funds’ for family upkeep, medical, etc, thereby circumventing or evading taxes. This practice of promoting illicit financial flows is counterproductive and should be stopped. The Reserve Bank has no appetite to put impediments on the conduct of free funds accounts but we cannot also remain naïve at the wanton abuse of the liberalised facility by a few nationalities. Accordingly, the Reserve Bank would like to remind the banking public to adhere to good principles in conducting transactions in their free funds accounts and for banks to continuously exercise and/or conduct Customer Due Diligence (CDD) or to adhere to the Know Your Customer (KYC) principles at all times.

Acquittal of Import Bills of Entry

All foreign payments for goods by corporates are required to be acquitted in CEBAS within 90 days from the date of payment or at any duration approved by Exchange Control, upon submission of the relevant ZIMRA Import Bills of Entry. All cross border payments for individuals and corporates shall continue to be captured in CEBAS in order to fully comply with the recording and accounting for imports.

Acquittal of Service Payments

Payments in respect of services shall be acquitted in CEBAS upon submission of a Certificate of Completion and Declaration Form confirming that the service was rendered. As Monetary Authorities, we urge all local entities entering into service contracts to try and include a skills training component as much as possible and contract local companies wherever possible.

Penalty Fee for Non-Acquittal of Import Bills of Entry

For the period February 2009 to 30 June 2014, the value of the accumulated outstanding Import Bills of Entry amounted to around US$5.8 billion. In a bid to ensure that importers clear such outstanding advance payments and enforce compliance, on 1 September 2014, Exchange Control granted a 90 day amnesty for importers to acquit their Import Bills of Entry. The amnesty expired on 31 December 2014. The outstanding bills that have not been acquitted as at 31 January 2015 stood at US$1.8 billion. Non-acquittal of foreign payments, with effect from 1 January 2015, are attracting an administrative penalty fee of 1% on the total un-acquitted payments. This penalty is necessary as some businesses lacked seriousness in the use and accounting for financial resources. Despite the liberalised exchange control environment and the generous amnesty, some businesses started to panic only when penalty fee was instituted. That wanton abuse of systems and procedures is poor corporate governance which should be avoided. In order for the Reserve Bank to continue to play a more facilitative role in economic recovery and to take into account of the representation by industry and commerce without nullifying the penalties already charged to offenders, the RBZ is with immediate effect, giving absolute amnesty on all import bills of entry not acquitted prior to 31 December 2013. In doing this, the Reserve Bank is trading amnesty for compliance. Going forward RBZ is adopting a zero tolerance on export and import documentation requirements.

Validation of Imports

In addition to off-site validations of import transactions, Exchange Control shall carry out random ex-post physical on-site import validation of imports to verify whether the country received true and fair value from its national resources.

Compliance Awareness

The Reserve Bank has noted the need to conduct public awareness campaign on compliance with best practices on foreign payments. In this regard, compliance workshops for stakeholders will be held in April 2015. The stakeholders to be included are law enforcement agencies, regulatory bodies, industry and commerce and civil society.

POLICY ADVICE

Tourism Development

Tourism is one of the fastest growing industries in the world. According to the United Nations World Tourism Organisation (UNWTO), the sector ranks fourth after energy and fuels in terms of global exports. In Zimbabwe, tourism has emerged as a major driver of economic and social development through generating foreign earnings, creating incomes, stimulating domestic consumption, and creating employment in both rural and urban areas. Its current contribution to national income is just below US$1 billion Tourism should be considered as a low hanging sector for the special economic zones concept. The logical starting point would need to be Victoria Falls where the country is endowed with the seventh wonder of the world, the Victoria Falls, (Mosi- Oa- Tunya). We now need policy measures to harvest from this natural resource and have a vision of making Victoria Falls as the ‘Tourist Hub of Africa’. This vision which dovetails well with the Ministry of Tourism and Hospitality’s vision of a US$5 billion tourism sector by 2020. This sector has a potential of growing very fast and requires less effort than the real sectors of the economy. The initial priority to realise the above dream would be to complete the master plan of the Victoria Falls and to provide it with the necessary designation of a special economic zone with facilities such as international business centre, offshore international banking that provides safe haven to all investors, thematic parks, cable cars, e.t.c. Benefits that would accrue to the economy from such developments could be tremendous, from employment, foreign exchange generation, e.t.c. Because of its importance to economic development, the pricing of the tourism services plays a critical role in stimulating domestic tourism and attracting foreign tourists.

Pricing of Tourism Services Using a Two Tier System