Some companies in Zimbabwe have started paying their employees extra money to help them survive the inflation that has seen prices of basic commodities increase drastically.

Among such companies are two banks, FBC and Nedbank Zimbabwe. A letter posted on social media sent to FBC employees shows that the bank is paying its employees an allowance this month to compensate for the inflation.

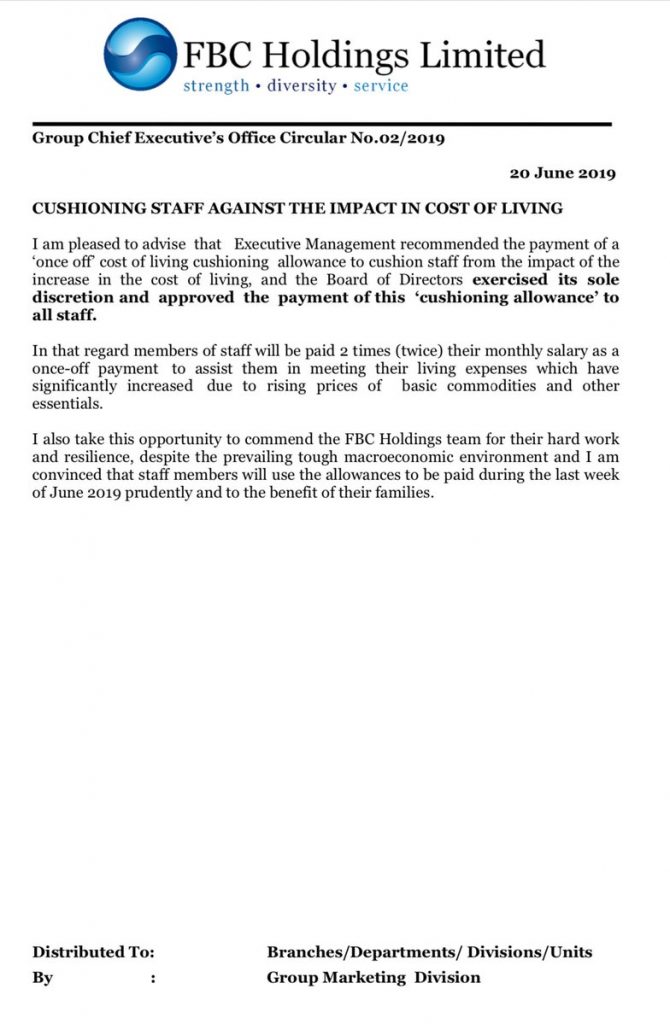

Says the letter:

Group Chief Executive’s Office Circular No.o2/2ot9

20 June 2019

CUSHIONING STAFF AGAINST THE IMPACT IN COST OF LIVINGI am pleased to advise that Executive Management recommended the payment of a `once off’ cost of living cushioning allowance to cushion staff from the impact of the increase in the cost of living, and the Board of Directors exercised its sole discretion and approved the payment of this ‘cushioning allowance’ to all staff.

In that regard members of staff will be paid 2 times (twice) their monthly salary as a once-off payment to assist them in meeting their living expenses which have significantly increased due to rising prices of basic commodities and other essentials.

I also take this opportunity to commend the FBC Holdings team for their hard work and resilience, despite the prevailing tough macroeconomic environment and I am convinced that staff members will use the allowances to be paid during the last week of June an9 prudently and to the benefit of their families.

Distributed To: Branches/Departments/ Divisions/Units

By: Group Marketing Division

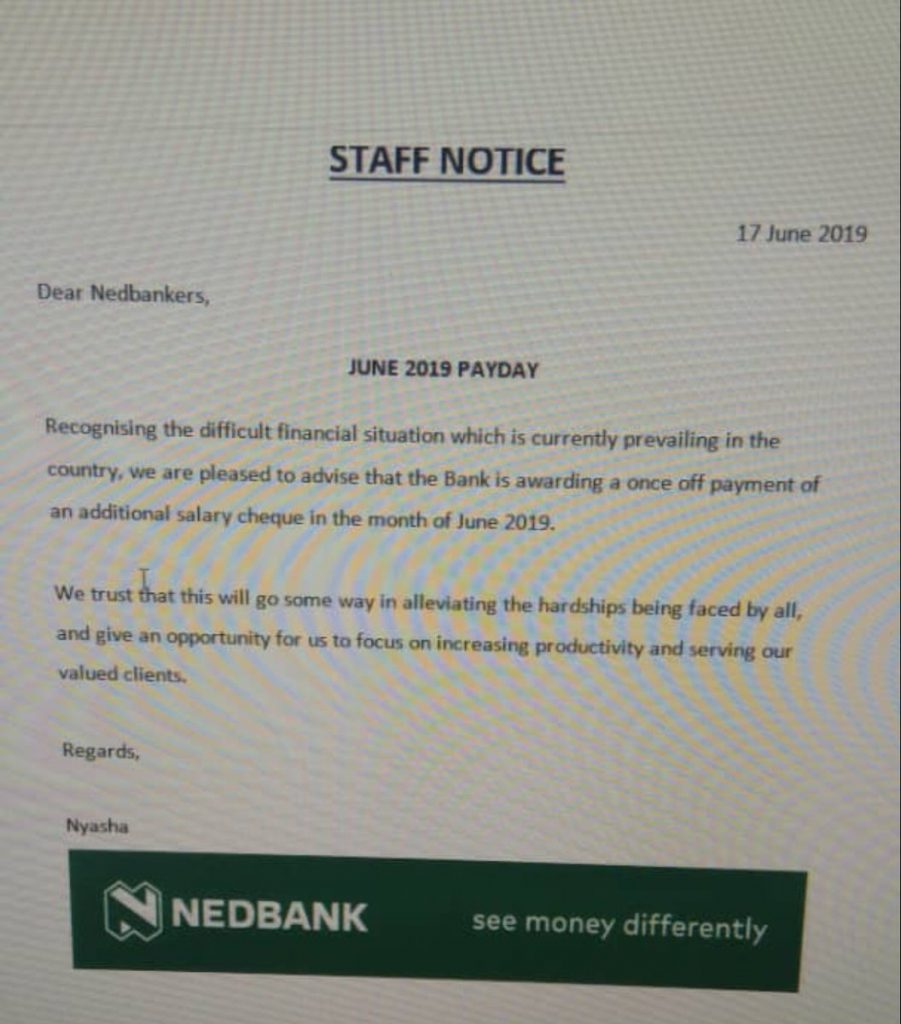

A letter sent to NedBank Zimbabwe employees reads:

Dear Nedbankers

June 2019 Payday

Recognising the difficult financial situation which is currently prevailing in the country, we are pleased to advise that the Bank is awarding a once off payment of an additional salary cheque in the month of June 2019.

We trust that this will go some way in alleviating the hardships being faced by all, and give an opportunity for us to focus on increasing productivity and serving our valued clients,

Regards Nyasha

Zimbabwe is currently undergoing a period of high inflation with prices of basic commodities changing up multiple times a week due to a continuously weakening local currency (the RTGS$). The currency has weakened from about 1:4 to the USD to now 1:12 on the parallel market in just a few months. The government has insisted that speculators and unscrupulous businesses are causing the price increases and the loss of value of the local currency in order to profiteer.