FULL TEXT: We Are Not Printing Money, The Financial Times Is Lying - RBZ

The RBZ has written a rebuttal statement dismissing reports by the Financial times that they have once again set up their printing press and they are printing money.

The lender of last resort tweeted the following statement:

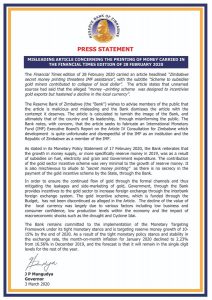

Misleading article concerning the printing of money carried in the Financial Times edition of 28 February 2020

The Financial Times edition of 28 February 2020 caried an article headlined. “Zimbabwe secret money printing threatens IMF assistance’, with the subtitle “Scheme to subsidise gold miners contributed to collapse of local dollar, The article stated that unnamed sources had said that the alleged “money —printing scheme was designed to incentivise gold exports but hastened a decline in the local currency,

The Reserve Bank of Zimbabwe (the “Bank”) wishes to advise members of the public that the article is malicious and mis.ding and the Bank dismisses the article with the conternpt it deserves. The article is calculated to tarnish the image of the Bank, and ultimately that of the country and its leadership, through misinforming the public. The Bank notes, with concern, that the article seeks to fabricate an International Monetary Fund (IMF) Executive Board’s Report on the Article IV Consultation for Zimbabwe which development is quite unfortunate and disrespectful of the IMF as an institution and the Republic of Zimbabwe as a member of the IMF.

As stated in its Monetary Policy Statement of 17 February 2020, the Bank reiterates that the growth in money supply, or more specifically reserve money in 2019, was as a result of subsidies on fuel, electriciry and grain and Government expenditure. The contribution of the gold sector incentive scheme was very minimal to the growth of reserve money. It is also mischeivious to allude to “secret money printing”. there is no secrecy in the of the old incentive scheme by the State, through the Bank.

In order to ensure the continu. flow of gold through the formal channels and thus mitigating the leakages and side-marketing of gold, Government, through the Bank provides incentives to the gold sector to increase foreign exchange through the interbank foreign exchange system. The gold incentive scherne, which is fund. through the Budget, has not been discontinu. as alleg. in the Article. The decline of the value of the local curre, was largely due to various factors including low business and consumer confidence, low production levels within the economy and the impact of macroeconomic shocks such as the drought and Cyclone Idai.

The Bank remains commit. to the implementation of the Monetary Targeting Framework under itr tight monetary .ance and is targeting reserve rnoney growth of 1°- 15% by the end of 2020. As a result of the tight monetary policy stance and .ability in the exchange rate, the month-on-month inflation for January 2020 declined to 2.230/0 from 16.56. in December 2019, and the forecast is that it will remain in the single digit levels for the re. of the year.

3 March 2020

Source: Twitter