Zimbabwe Dollar Fell By Nearly 70% On Parallel Market Since January - Advisory Firm

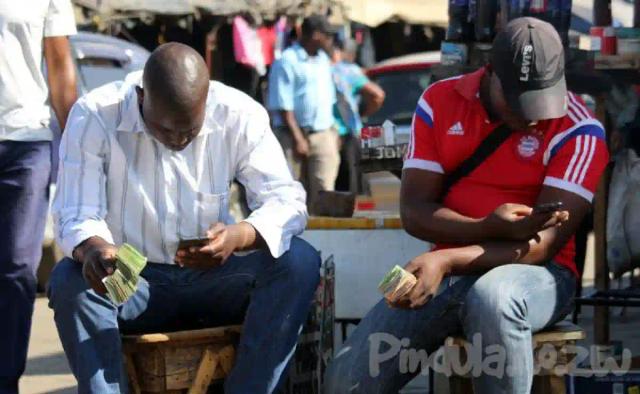

Data from a leading advisory firm shows that Zimbabwe’s local currency has fallen by nearly 70% since the beginning of the year on the parallel market, compared to about 30% on the official market.

Inter Horizon Securities (IH) in its latest report on Tuesday said:

Since the beginning of the year, the interbank rate has depreciated by 29.2% from 81.7866 to 105.6684. Despite the RBZ (Reserve Bank of Zimbabwe) maintaining a hawkish approach on monetary policy and against our intuition, the parallel market rate has been on a run.

FeedbackCurrently, at US$1:$194, the US$/ZW$ parallel exchange rate has increased by 68.6% from January’s rate of US$1:$115. The premium between the two rates continues to widen. Inflation has also started increasing as companies index prices on the parallel market exchange rate.

IH predicts that the 2021/22 agricultural season will increase government spending on agricultural activities. Added the advisory:

We also believe the need to remunerate civil servants as the year closes will exert additional pressure on government coffers and also contribute to extra liquidity in the economy. As a result, we anticipate the parallel rate premium to widen further.

IH also observed that the RBZ foreign currency auction system had been successful in stabilising the economy through increased availability of foreign currency thus slowing down the depreciation rate of the local currency.

The amount of money allotted on the auction has gradually increased from US$26.67 million disbursed on the first day of the auction to US$41.95 million recorded last week of October 2021.

However, over the past few weeks, RBZ has been meeting about 80% of the total accepted bids thereby pushing the rest and businesses which do not qualify to participate in the auction to go to the parallel market. Demand rose as production increased.

More: NewsDay

Tags

0 Comments

Leave a Comment

Generate a Whatsapp MessageBuy Phones on Credit.

More Deals