Some Tips On How To Avoid "Get-rich-quick" Financial Fraud

Bomikazi Zeka and Abdul Latif Alhassan, economic researchers at The Conversation, warn of common financial traps and offer some tips to avoid “get-rich-quick” financial fraud.

Consumers worldwide are struggling with rising food and fuel prices, making it challenging to remain financially stable and fraudsters take advantage of such economic uncertainty by luring people into fraudulent activities.

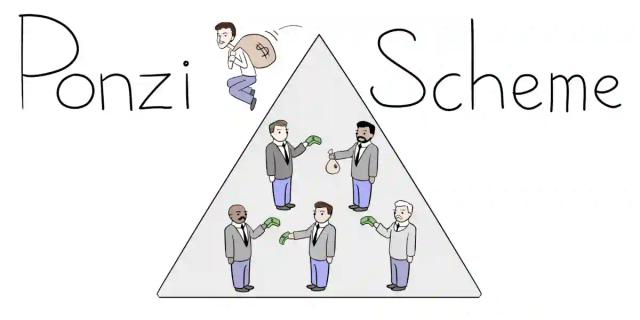

They say Ponzi and pyramid schemes have defrauded millions of people worldwide by promising unrealistic financial benefits through misrepresentation of information and identity.

There are five tell-tale signs of a “get-rich-quick” scheme: exaggerated returns, constant recruitment of new members, the urgency to join, unregistered schemes, and the use of testimonies from existing members.

They say legitimate investments are transparent and registered with regulatory authorities. Investors should conduct their investigations and report any scams to the relevant authorities to avoid unnecessary financial distress. Remember, wealth comes from sound investment strategies made over time.

HOT DEALS:

itel A70 - (128GB, 3GB RAM) $89,

itel A70 - (256GB, 4GB RAM) $99

itel P40 (128GB, 4GB), (6000mAh) $99

itel P40 (64GB, 4G), (6000mAh) $93

LATEST:

itel S24 (128GB) $124 (108MP camera)

itel S24 (256GB) $159 (108MP camera)

Cash on Delivery in Harare & Bulawayo. Tinotumira kwamuri inosvika.

WhatsApp: 0783 450 793

The five tell-tale signs of a “get-rich-quick” scheme in detail:

1). Fraudsters offer exaggerated returns with little to no risk in a short time. However, the golden rule of investing is that it takes time to make money. If someone promises to help you amass a small fortune in a short time, it’s best to be cautious and question the legitimacy of their scheme. The second rule of investing is that higher returns come with higher risks. No investment is entirely risk-free or guarantees significant returns. Investments that promise substantial returns tend to be quite risky, which may not be suitable for people with a low appetite for risk.

2). Fraudsters constantly recruit new members to join their scheme. Such schemes rely on the investments of new members to pay existing members. Once the number of existing members exceeds new members, the scheme collapses. At best, investors lose out on the promised returns. At worst, they lose all their invested money. When the scheme collapses, it’s almost impossible to recover lost money because it was given to a stranger. Remember that financial fraud includes a misrepresentation of identity.

3). A classic characteristic of a “get-rich-quick” scheme is the urgency to join without clear information on how it works. Such schemes offer no clear answers about their nature, investments, returns, or credentials. Legitimate investments are transparent and provide investors with all the necessary information to make informed decisions. Properly checking “get-rich-quick” schemes will reveal their fraudulent nature. This is why fraudsters often use urgency and coercion to prompt immediate financial commitment under the guise of a once-in-a-lifetime opportunity to get rich.

4). Another sign of a “get-rich-quick” scheme is that it’s not registered or regulated by any recognized authority. Regulatory authorities are crucial because they monitor the behaviour of financial service providers and protect consumers by ensuring their best interests are taken into account. The protection provided by financial regulators also instils confidence in financial systems. “Get-rich-quick” schemes are not registered and operate outside the framework of regulatory bodies. This makes investors more vulnerable to losses and makes it more challenging to seek legal recourse when the loss occurs. Legitimate investments in any country are offered by authorized financial service providers. You can search for any authorized financial service provider on the authority’s website.

5). Fraudsters use the testimonies of existing members who have earned big returns to promote their scheme. At the initial stages, such schemes tend to pay out to early investors, who are encouraged to share their wealth to promote the scheme. This creates the impression that others can earn high returns too. However, these schemes are unsustainable and unethical as one person gains wealth by deceiving others. It’s important to remember that if something sounds too good to be true, it probably is. Wealth comes from sound investment strategies and decisions made over time. Any promise of getting rich quickly should be treated with scepticism as it will eventually reveal its fraudulent nature. Recognizing the signs of “get-rich-quick” schemes can prevent unnecessary financial distress.